Project details

Client

Boston Consulting Group, India

Role

UX Designer, Full-Stack Developer

Category

Featured, UX

overview

Our team of 2 was called in to help conceptualize and prototype a software system to enable a more streamlined payments experience for the customers of a large Indian retail bank. We were helping out part of a larger effort at the Boston Consulting Group, India for their client, who were about to enter India’s large and beleaguered retail banking sector. This was a 2 week long rapid prototyping project to help the BCG team test out various options for there project.

High Level Goals

○ Understand how the Indian consumer makes bank transactions on a day to day basis

○ Identify pain points in currently available systems

○ Locate untapped opportunities to push the usage of mobile payments for a larger variety of economic activity

Research

We joined the team at BCG in diving into the current user experience of leading retail banks. The standing payments system in India requires users to exchange account identifiers in the form of bank account number and branch or something called an MMID (Mobile Money Identifier). This proved to be cumbersome for users and prone to human error.

Our key insight boiled down to:

Consumers want to make payments to people, not account numbers

-

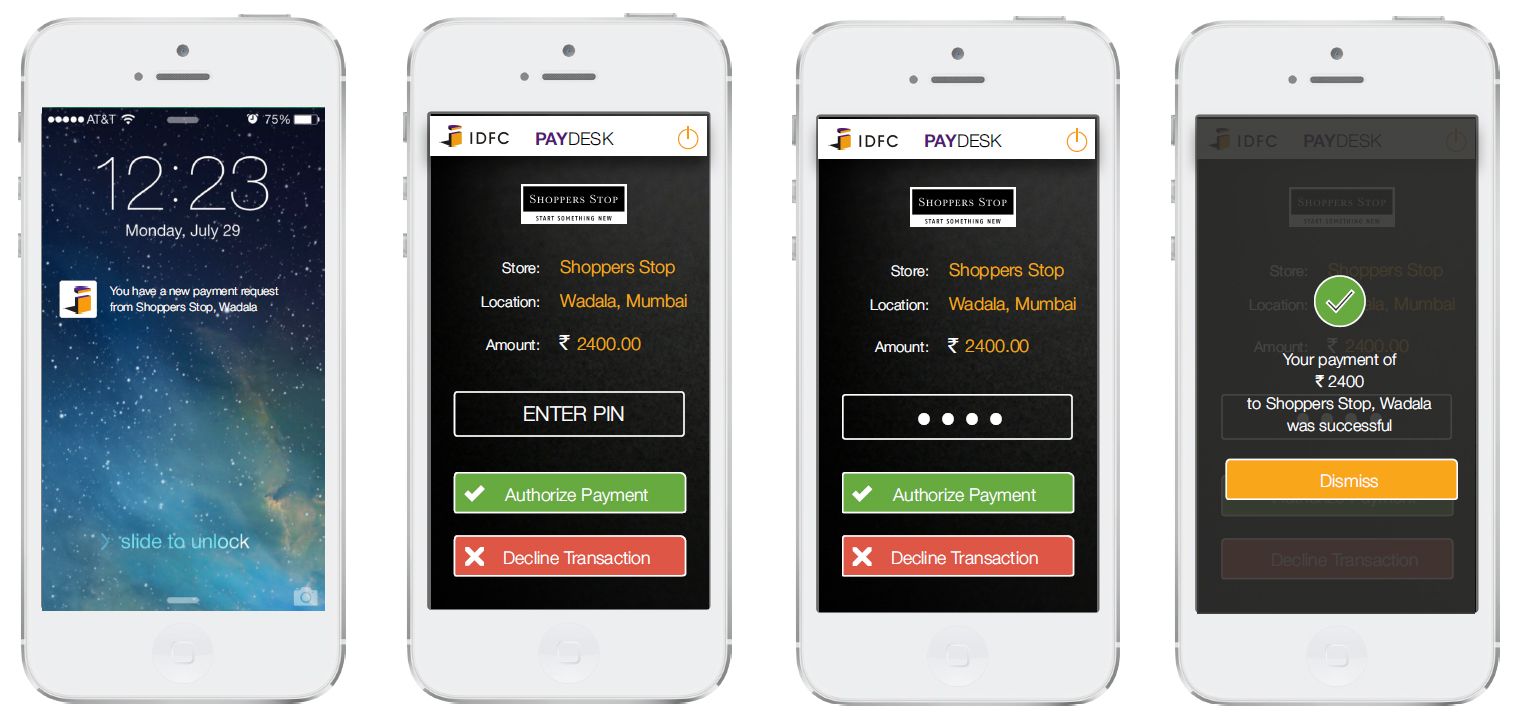

Prototyping

Much of our early prototyping was based around the experience of merchant payments, as we tried to probe ways to ease the friction in the experience, while maintaining account security.

While, feedback on our attempts at tackling merchant payments wasn’t great, we felt we made great headway on the personal payments front, with a focus on removing the need for copy-pasting cumbersome large number sequences.

OUTCOME

As part of our final design, we wanted to provide a more seamless experience where people could rely on a more human readable proxy to these numbers. This was done via two mediums: phone number and social media accounts.